Promoting the early stages of the Start-up Communities Concept

1.

Do you consider

that your country is advanced in the area of entrepreneurship?

France has a complicated relationship with entrepreneurship. Since few

months, the government is trying to change its image regarding start-ups[1].

After announcing some measures taxing start-ups, the government is now trying

to seduce entrepreneurs. France has plenty of potential as a source of innovative

and competitive new ventures, but has struggled to convert this into solid

support for its entrepreneurs. This is an unfortunate reality for a country of

this size and at this level of development (it is the fifth largest economy in

the world in terms of GDP). An important part of the problem appears to be the

lack of a cultural foundation for entrepreneurship. In this area, France’s

entrepreneurs were much more negative than their G20 peers, according to the EY

G20 Entrepreneurship Barometer 2013[2].

2.

If yes what

indicators would you use to evidence this (number of start-ups, number of patents registered, number of self-employed

professionals etc)? If no,

how do you think you can benefit from countries where this concept is advanced?

“French

Tech” label was just created by the government to accelerate growth among

French digital startups, going from “start” to “up” in order to create world

players, to establish French startups on the international market and to

attract international talent and investors[3].

538 185 companies have been created in 2013 according to the INSEE[4].

More and

more incubators in France, plan to have the biggest incubator in the world in

2016 with Xavier Niel’s (Free CEO) project, the “Halle Freyssinet” in the 13th

arrondissement of Paris.

Crédit

Impôt Recherche (Research Tax Credit) : Launch in 2004, this aims to

facilitate access to funding and raise entrepreneurship culture. The research

tax credit provides corporate tax relief for R&D expenses. It supports

companies’ R&D efforts and increases their competitiveness by allowing a

30% deduction on the first €100m of R&D expenditure and 5% thereafter.

After its reinforcement in 2004, the number of businesses using the credit has

increased by 80% since 2008, to 18,000 companies. The credit has generated

total tax savings for businesses of more than €5b.

3.

Which factors do

you consider as most critical for the development of an entrepreneurial

culture?

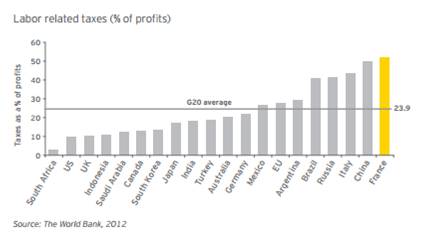

The level of taxation is perhaps the clearest obstacle, both in terms of

its direct effects on entrepreneurs, and as a symbol of the country’s relative

unease with private enterprise. Business taxes are above the average for mature

economies. And although the Government’s attempt to introduce a 75% tax rate on

wages above €1m has yet to be clearly defined and implemented, it has sent an

unfortunate signal about the country’s support for entrepreneurship.

The labour law is also very rigid and the work force is highly taxed.

4.

Which method(s)

would you consider as the most appropriate to assist countries lagging in the

entrepreneurship, i.e. helping entrepreneurs gain access to institutional/angel investors,

transferring expertise through an online platform, providing online support in

the evaluation of business plans, providing access to networks where

entrepreneurs meet.

International

initiative such as crowdfounding and business angels should be disseminated. This

would be possible by a intense communication; online plateforme is a way to

achieve that. It could be a good idea to have a “.eu” address available in

several EU languages to communicate about successful projects. It could

emphasizes on testimonies.

5.

Do you think

entrepreneurship can be promoted by the government or through private

initiatives (i.e. via

innovation schemes or via the development of a network of angel investors or

both)?

Both; it is the role of the government to encourage innovation and

entrepreneurship by facilitating creation and development of start-ups. Taxes

mustn’t be too high and labour

law need to be adapted. On the other hand, government can’t be the only one

promoting entrepreneurship. Private initiative need to be encouraged such as

business angels.

6.

How would you

define the role of the European Union in the entrepreneurship arena?

EU initiatives are not very well know in France.

This is probably due to the importance of governmental grants addressed to

start-ups. But after some researches, we can find that EU is committed in

entrepreneurship, even providing a web page gathering good practices in Europe[5].

7.

Do you consider

project management and planning as a critical area for the success of a new

venture?

Not critical but definitely fundamental and need to be defined before

launching the project.

8.

Please define

the most important stages in which you would you divide the effort required for

a new start-up (i.e. concept development, design, prototyping, commercial deployment).

Market study

Possible grants research

Administrative issues

Concept development

Prototyping

Networking

Commercial deployment